Financial Intelligence Organizations

Empowering Financial Intelligence Agencies to Combat Financial Crimes with AI-powered Predictive Intelligence

Financial Crimes Are Getting Smarter

Are Our Detection Tools Evolving Fast Enough?

As the financial world accelerates, so do the tactics of bad actors. From complex laundering networks to the rise of untraceable digital assets, today’s threats demand more than manual checks and siloed data. Financial intelligence agencies are being called to adapt — with speed, precision, and insight.

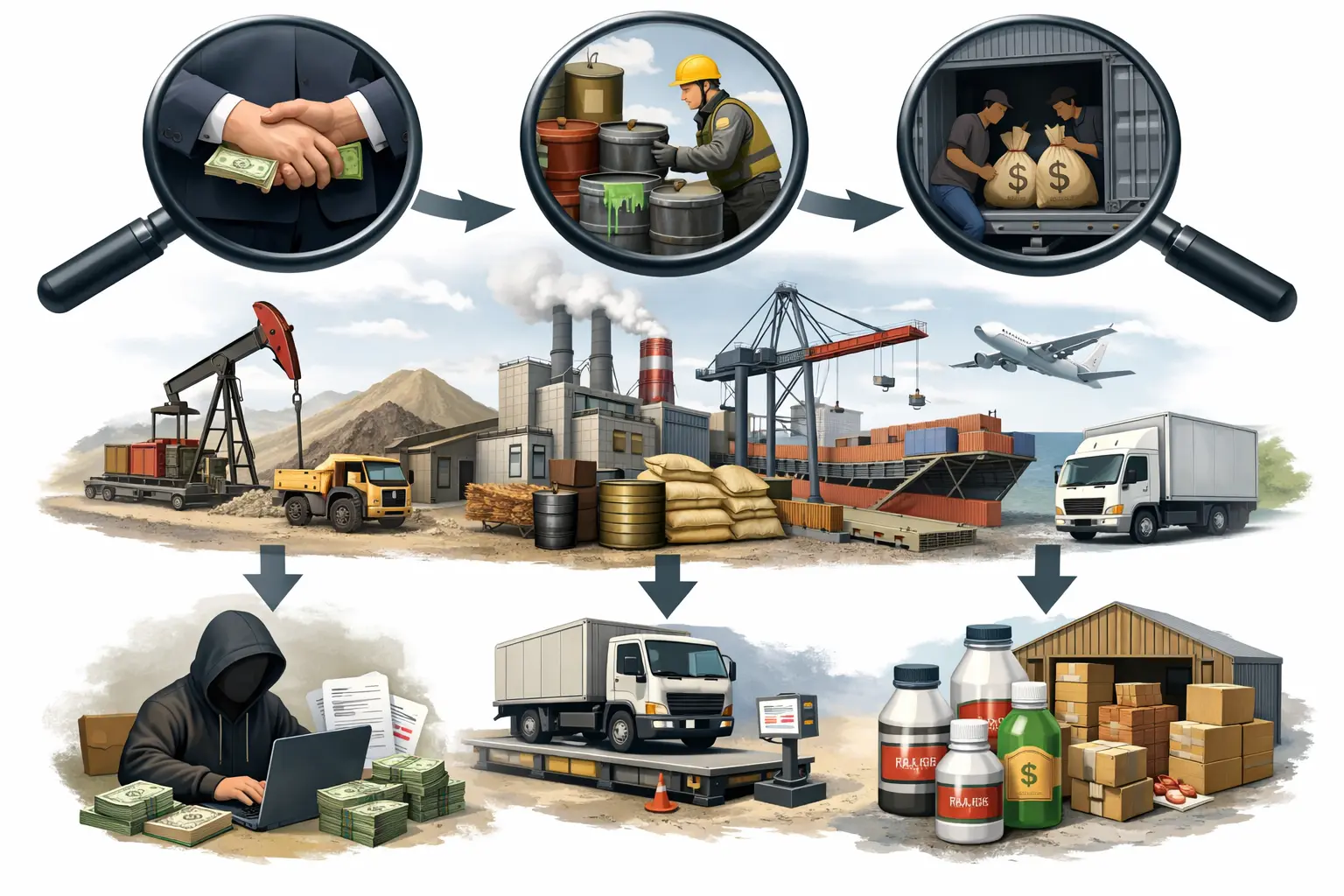

Complex Money Laundering Networks

Sophisticated layering of transactions across accounts, shell companies, and offshore havens.

High Volume of Suspicious Transactions

Manual investigation of alerts results in backlogs and delays.

Digital Payments & Virtual Assets

Cryptocurrencies and fintech systems enable anonymous, cross-border fund transfers.

Limited Cross-Institutional Visibility

Silos between banks, financial intelligence agencies, and enforcement bodies restrict holistic financial intelligence.

Rising Cases of Fraud, Terror Financing, and Insider Threats

Criminals are exploiting gaps in KYC, transaction monitoring, and regulatory controls.

Stay Ahead of Illicit Networks with Innefu’s AI-Powered Financial Crime Intelligence Platform

Innefu enables financial crime units, regulators, and enforcement agencies to cut through the noise, connect the dots, and act decisively — all in real time. Our end-to-end platform delivers proactive surveillance, advanced analytics, and integrated case management to uncover even the most concealed financial threats.

AI-Based Suspicious Transaction Monitoring

Go beyond rule-based alerts. Innefu’s models flag anomalies using pattern detection, behavioral profiling, and network linkages.

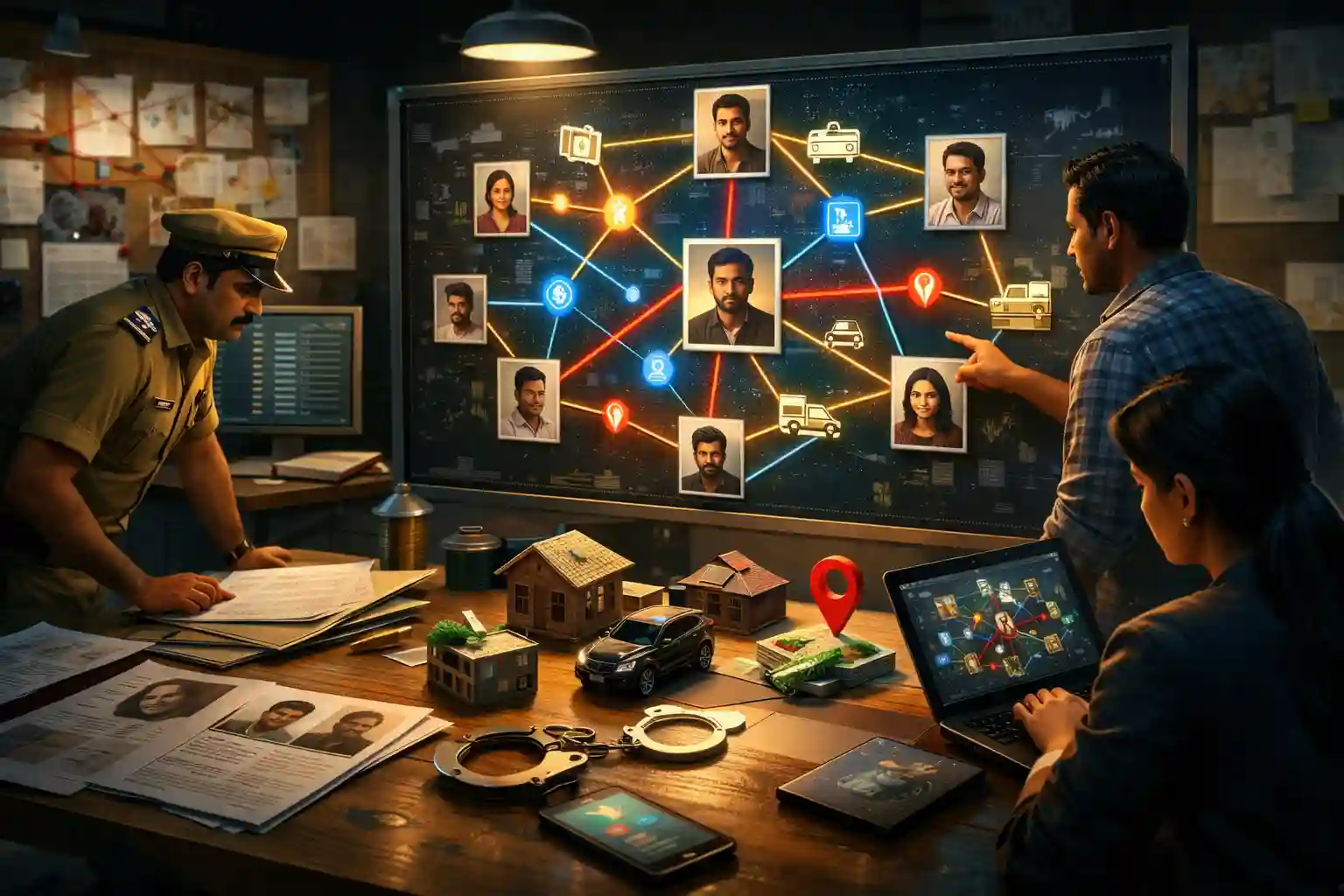

Entity Linkage & Network Visualization

Map connections between individuals, businesses, transactions, and geographies to uncover hidden financial crime rings.

KYC & Beneficial Ownership Intelligence

Uncover layered ownership structures, shell entities, and high-risk customers using multi-source enrichment and document intelligence.

AML Case Management Platform

From STR generation to investigation and reporting — streamline your compliance with a full-cycle automation solution.

Cross-Border Transaction Intelligence

Identify trade-based money laundering, hawala patterns, and multi-jurisdictional fund flows with advanced correlation.

PEP & Sanctions Monitoring

Real-time screening against global watchlists, sanctions, adverse media, and politically exposed persons (PEPs).

The Financial Intelligence Fusion Centre

A centralized intelligence infrastructure for financial crime agencies, built to fuse transactional, OSINT, regulatory, and investigative data into a unified threat intelligence environment.

We have developed a product based on a Big Data framework that addresses financial fraud on an individual basis.

Use Cases for Financial Intelligence Agencies

- Money Laundering Detection

- Cross-Border Transaction Monitoring

- Shell Company & Beneficial Ownership Exposure

- Trade-Based Money Laundering Analysis

- Insider Fraud & Suspicious Employee Profiling

- Cryptocurrency Risk Monitoring

Why Financial Intelligence Units Choose Innefu?

- Proven deployments across enforcement, central banks & regulatory authorities

- Flexible integration with core banking, payment systems & compliance databases

- AI-driven anomaly detection with explainable risk scores