In an era of complex financial crimes, fund trail analysis has become a mission‑critical capability for Finacial Intelligence Agencies, Income Tax Departments, and other economic law‑enforcement agencies. Criminal networks today use layered transactions, shell companies, digital wallets, and cross‑border channels to obscure the origin and destination of illicit funds.

This blog explains what fund trail analysis is, why it matters, key challenges faced by investigators, and how AI‑powered platforms like Prophecy Eagle I from Innefu enable faster, more accurate financial investigations.

What is Fund Trail Analysis?

Fund trail analysis is the systematic process of tracking the movement of money from its source (origin) to its final destination, across accounts, entities, intermediaries, and jurisdictions.

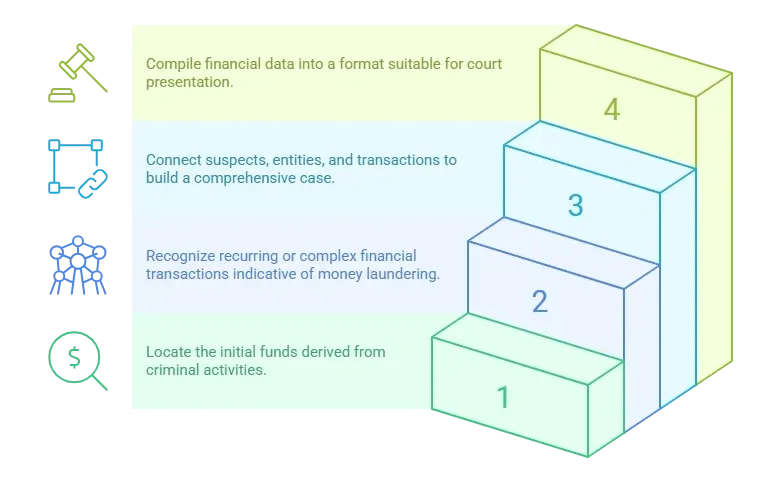

It helps investigators:

- Identify proceeds of crime

- Detect money laundering and layering patterns

- Establish linkages between suspects, entities, and transactions

- Generate court‑admissible financial evidence

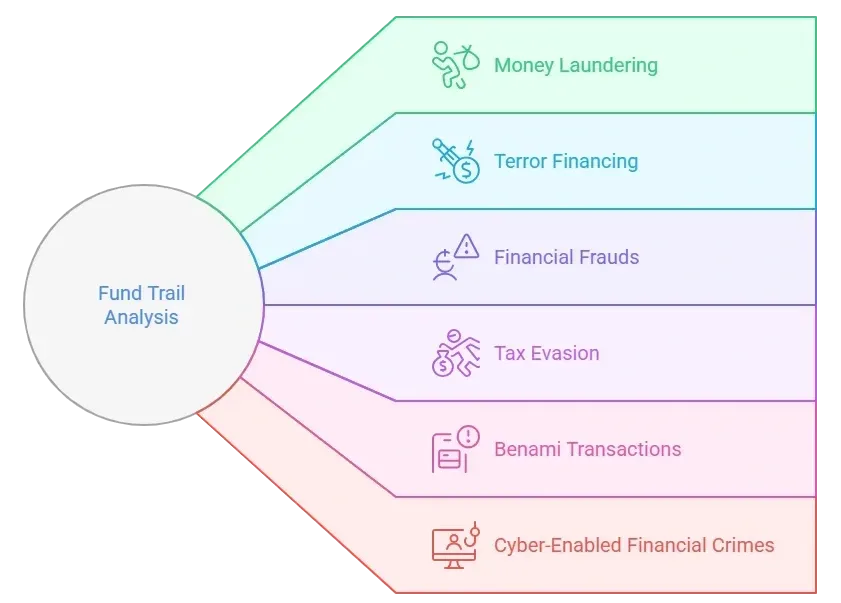

Fund trail analysis is widely used in investigations related to:

- Money laundering

- Terror financing

- Financial frauds

- Tax evasion

- Benami transactions

- Cyber‑enabled financial crimes

Why Fund Trail Analysis is Critical for Agencies like ED & Income Tax

Financial crimes rarely occur in isolation. They involve networks of accounts, shell entities, and intermediaries designed to hide accountability.

For agencies such as ED, Income Tax, and FIUs, fund trail analysis enables:

- Uncovering layered transactions across banks and entities

- Identifying beneficial ownership behind shell companies

- Tracing proceeds of crime under PMLA and allied laws

- Linking financial data with intelligence inputs

- Supporting attachment, seizure, and prosecution processes

Without automated fund trail analysis, investigators often face months of manual data correlation, slowing down enforcement actions.

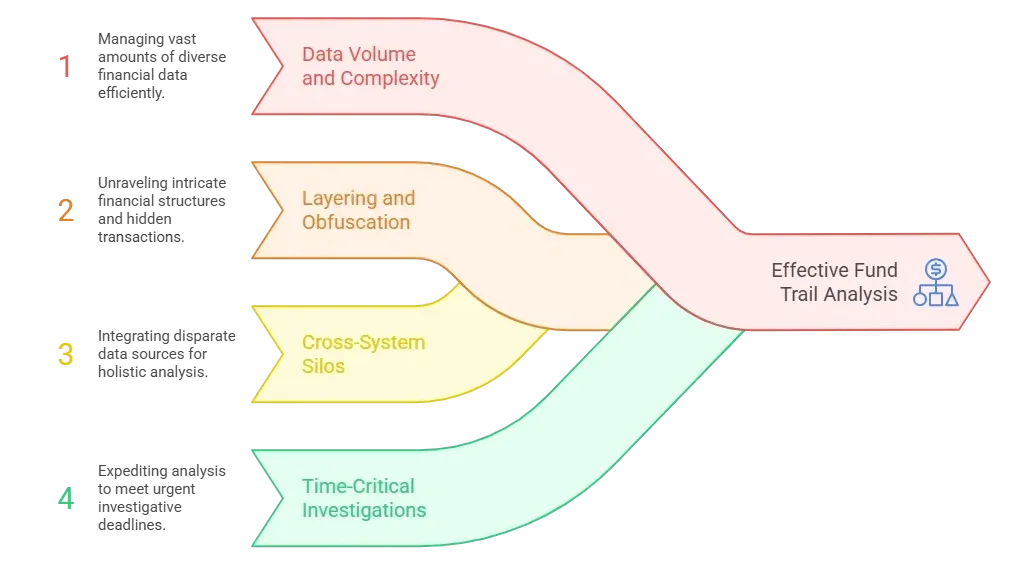

Common Challenges in Fund Trail Analysis

Despite its importance, traditional fund trail analysis faces multiple challenges:

1. Volume and Complexity of Data

- Thousands of bank statements

- Multiple formats (PDF, Excel, CSV)

- Transactions spread across years

2. Layering and Obfuscation

- Circular transactions

- Multiple intermediary accounts

- Use of shell companies and trusts

3. Cross‑System Silos

- Banking data

- Tax records

- Corporate registries

- Intelligence inputs

4. Time‑Critical Investigations

- Delays impact attachment proceedings

- Manual analysis slows decision‑making

These challenges demand AI‑driven fund trail analysis platforms rather than spreadsheet‑based methods.

How AI Transforms Fund Trail Analysis

Modern fund trail analysis platforms leverage Artificial Intelligence, Graph Analytics, and Advanced Data Fusion to accelerate investigations.

Key AI‑enabled capabilities include:

- Automated ingestion of bank statements and financial data

- Entity resolution (merging duplicate or alias identities)

- Transaction pattern detection

- Graph‑based visualization of fund flows

- Risk scoring and anomaly detection

This is where Prophecy Eagle I plays a critical role.

Fund Trail Analysis with Prophecy Eagle I

Prophecy Eagle I is Innefu’s AI‑powered intelligence and analytics platform designed for financial intelligence and investigation agencies.

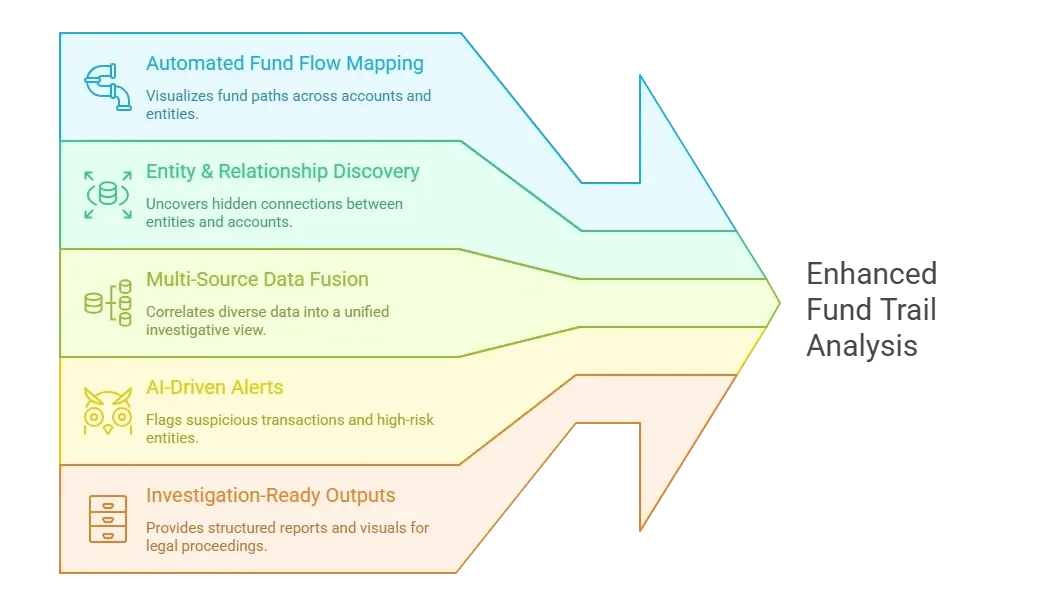

Key Capabilities for Fund Trail Analysis

1. Automated Fund Flow Mapping

- Tracks money movement across multiple accounts and entities

- Visualizes source‑to‑destination fund paths

- Identifies circular and layered transactions

2. Entity & Relationship Discovery

- Links individuals, companies, accounts, and intermediaries

- Reveals hidden connections using graph analytics

- Identifies beneficial ownership structures

3. Multi‑Source Data Fusion

- Bank statements

- Corporate data

- Tax records

- Case‑specific intelligence inputs

All data is correlated into a single investigative view.

4. AI‑Driven Alerts & Risk Indicators

- Flags suspicious transaction patterns

- Highlights high‑risk entities and accounts

- Supports prioritization of investigation leads

5. Investigation‑Ready Outputs

- Timeline‑based fund movement reports

- Visual graphs for briefings and case reviews

- Structured outputs suitable for legal proceedings

Use Cases for ED, Income Tax & FIUs

Prophecy Eagle I supports multiple real‑world fund trail analysis scenarios:

- Money Laundering Investigations under PMLA

- Tax Evasion & Undisclosed Income Detection

- Shell Company & Benami Network Analysis

- Fraud Proceeds Tracing

- Terror Financing & Organized Crime Cases

The platform enables agencies to move from data overload to actionable financial intelligence.

Benefits of AI‑Driven Fund Trail Analysis

⏱ Significant reduction in investigation time

🎯 Higher accuracy in identifying fund linkages

🔍 Improved visibility into complex financial networks

⚖ Stronger, evidence‑backed prosecution support

🔐 Secure, role‑based access for sensitive data

In short, Fund trail analysis is no longer optional. It is foundational to modern financial intelligence and enforcement operations. As financial crimes grow more sophisticated, agencies require platforms that combine automation, AI, and investigative intelligence.

Prophecy Eagle I empowers Financial Intelligence Agencies to conduct faster, deeper, and more reliable fund trail analysis, turning complex transaction data into decisive investigative outcomes.

Frequently Asked Questions (FAQ)

What is fund trail analysis?

Fund trail analysis is the process of tracing the movement of money from its source to its final destination across bank accounts, entities, and intermediaries to identify proceeds of crime and suspicious financial activity.

Who uses fund trail analysis?

Fund trail analysis is primarily used by Enforcement Directorates (ED), Income Tax Departments, Financial Intelligence Units (FIUs), and other financial crime investigation agencies.

Why is fund trail analysis important in money laundering cases?

It helps investigators uncover layering, identify beneficial ownership, trace proceeds of crime, and build legally defensible financial evidence under laws such as PMLA.

What challenges do investigators face in fund trail analysis?

Common challenges include large volumes of transaction data, complex layering, multiple data sources, manual correlation, and time-sensitive enforcement requirements.

How does AI help in fund trail analysis?

AI enables automated data ingestion, entity resolution, transaction pattern detection, graph-based fund flow visualization, and risk scoring, significantly reducing investigation time.

What is Prophecy Eagle I?

Prophecy Eagle I is an AI-powered intelligence and analytics platform by Innefu designed to support fund trail analysis, financial intelligence, and complex investigations for law-enforcement and regulatory agencies.

Can fund trail analysis outputs be used in legal proceedings?

Yes. Modern platforms generate structured reports, timelines, and visual evidence that support prosecution, attachment, and adjudication processes.