The Illusion of Compliance

Banks generate millions of suspicious transaction alerts every year. Regulators mandate reporting. Compliance dashboards show activity and rising Suspicious Transaction Reports (STR) volumes.

On paper, the system appears active and responsive. Yet large-scale money laundering networks continue to operate, moving funds across borders, routing transactions through shell entities, structuring deposits across mule accounts, and layering transfers to obscure origin.

The issue is not the absence of alerts. It’s the gap between alerts and intelligence. Across financial ecosystems, enforcement agencies face:

- Alert fatigue driven by high volumes of STRs

- Fragmented financial data spread across institutions and jurisdictions

- Manual STR analysis that slows prioritization

- Delayed inter-agency coordination across FIUs, tax authorities, customs, and enforcement units

Rule-based AML monitoring systems are designed primarily to ensure compliance. They generate alerts when thresholds are breached. But enforcement requires something deeper, the ability to connect isolated transactions into structured financial networks.

Modern money laundering is not a single transaction problem. It is a network problem.

This blog explains how modern financial intelligence platforms strengthen AML enforcement by converting suspicious transaction data into structured, network-driven investigative intelligence.

Key Takeaways

- Alerts Alone Are Not Intelligence:High STR volumes do not automatically translate into effective enforcement.

- Financial Crime Is Network-Driven:Money launderingoperates through structured, multi-entity ecosystems.

- Data Integration Is Foundational:Unified financial data enables complete investigative visibility.

- Graph Analytics Exposes Hidden Links:Network mapping reveals beneficial ownership and circular fund flows.

- Risk-Based Prioritization Improves Impact:Dynamic scoring helps investigators focus on high-value cases first.

- AI Enhances Pattern Detection:Adaptive analyticsidentify evolving laundering techniques.

- Workflow Integration Supports Prosecution:Structured case management strengthens evidence documentation.

- Enforcement Requires Structural Modernization:AML platforms enable the transition from compliance monitoring to intelligence-led investigation.

Whatis a Financial Intelligence Platform?

Definition

A financial intelligence platform is an integrated analytics system that consolidates transaction data, suspicious transaction reports (STRs), entity records, corporate information, and external intelligence inputs to detect, prioritize, and investigate potential money laundering activities.

Unlike basic AML software that focuses on rule-based detection, a financial intelligence platform enables:

- Multi-source data integration

- Network and graph analysis

- Risk-based prioritization

- Structured case development

- Cross-agency investigative collaboration

It moves beyond alert generation and supports intelligence-led AML enforcement. AML software often refers to compliance-focused systems.

AML analytics and financial intelligence platforms refer to investigative and enforcement-grade systems.

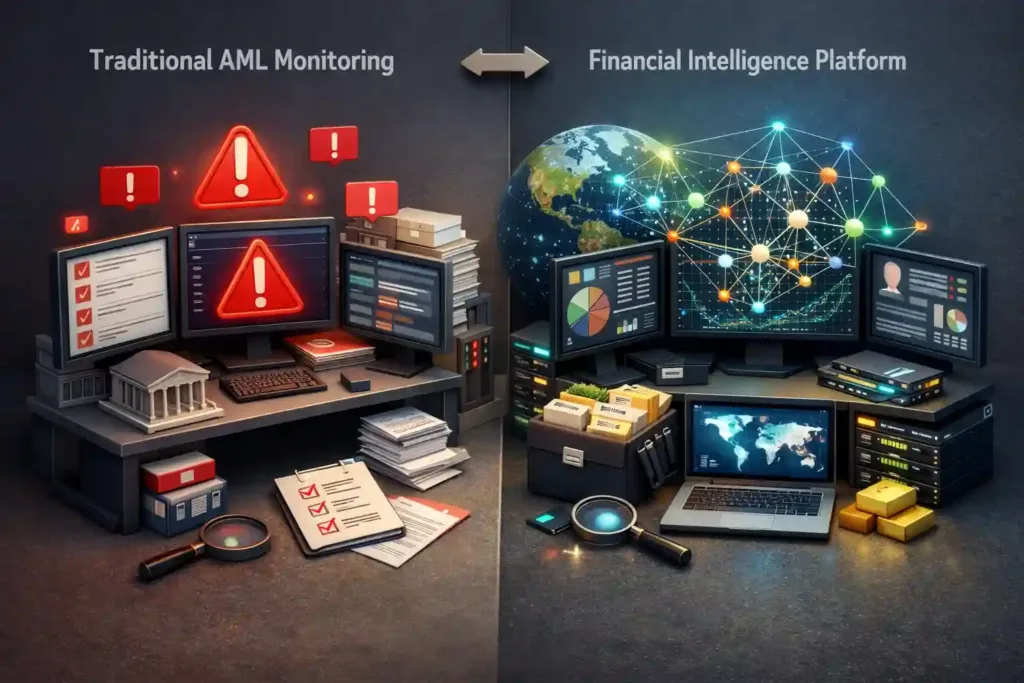

How It Differs from Traditional AML Monitoring

Traditional AML monitoring systems are primarily rule-driven. They:

- Trigger alerts based on predefined thresholds

- Review transactions at the individual bank level

- Operate with static compliance rules

- Focus on regulatory reporting obligations

A financial intelligence platform, by contrast:

- Uses risk-based network analysis instead of isolated alerts

- Fuses data from multiple institutions and intelligence sources

- Applies adaptive analytics rather than fixed thresholds

- Prioritizes investigative intelligence over compliance documentation

This distinction defines the evolution from AML monitoring to AML investigation tools. Compliance systems generate signals. Financial intelligence platforms generate insight.

Why AML Enforcement Needs Intelligence, Not Just Alerts

For enforcement agencies and financial intelligence units (FIUs), the challenge is not detecting suspicious transactions, it is uncovering structured financial crime networks.

Alert Fatigue

Enforcement bodies receive extremely high volumes of STRs.

Challenges include:

- Large numbers of low-risk alerts

- Minimal contextual linkage between reports

- Repeated reporting on the same entities without network analysis

When alerts are reviewed in isolation, investigators spend significant time validating transactions that may not be part of structured laundering activity.

Without prioritization and clustering, high-risk networks can remain hidden within alert noise.

Layering & Structuring Techniques

Modern money laundering relies on complexity.

Common techniques include:

- Mule accounts used to fragment deposits and withdrawals

- Circular transactions that obscure origin through repeated routing

- Shell companies masking beneficial ownership

- Layered fund transfers across multiple jurisdictions

Rule-based monitoring may detect unusual transactions. However, identifying the broader laundering architecture requires network-based analysis and entity linkage.

Money laundering is rarely linear. It is deliberately designed to appear fragmented.

Cross-Border & Multi-Institution Complexity

Funds often move:

- Across multiple banks

- Through cross-border remittances

- Between corporate and individual accounts

- Across trade and customs channels

When financial data remains siloed within individual institutions, enforcement agencies struggle to see the full transaction chain.

AML enforcement increasingly depends on the ability to fuse:

- Banking transaction data

- Corporate registry information

- Customs records

- Tax filings

- International intelligence inputs

Without integrated visibility, investigators operate with partial pictures.

Limited Investigator Bandwidth

Financial intelligence units face resource constraints:

- Limited analyst teams

- Increasing reporting volumes

- Complex, multi-layered cases

- Pressure for timely regulatory action

Manual review processes slow case progression and dilute investigative focus. Intelligence-led platforms reduce manual correlation and enable investigators to focus on high-risk networks rather than individual alerts.

For AML enforcement, the structural shift is clear – from reviewing transactions to mapping financial ecosystems; from compliance-driven monitoring to intelligence-driven investigation.

Core Capabilities of a Modern Financial Intelligence Platform

A modern financial intelligence platform is not just an alert management system. It is an investigative infrastructure designed to uncover structured financial crime networks. Below are the core capabilities that define an enforcement-grade system.

Multi-Source Data Integration

Effective AML enforcement begins with unified visibility. A financial intelligence platform enables financial data integration for AML by consolidating:

- Banking transaction records

- Suspicious Transaction Reports (STRs)

- KYC and customer profile records

- Corporate registry data

- Customs and tax inputs

- External intelligence feeds

Instead of analyzing transactions in isolation, investigators gain a single intelligence view across institutions and data silos.

This integration allows enforcement agencies to:

- Identify entity overlaps across banks

- Detect inconsistencies between corporate filings and transaction behaviour

- Cross-reference tax declarations with fund flows

- Combine structured and unstructured intelligence inputs

Without integration, complex laundering structures remain fragmented. With it, investigators can analyze financial ecosystems holistically.

Network & Graph Analytics

Money laundering is network-driven, not transaction-driven. Modern AML network analysis software uses graph analytics for financial crime detection by mapping relationships between:

- Individuals

- Accounts

- Companies

- Directors

- Phone numbers

- Transaction pathways

Key capabilities include:

- Beneficial ownership mapping

- Linked entity detection across institutions

- Circular transaction identification

- High-risk node prioritization within networks

Graph analytics for financial crime enables investigators to visualize layered structures that traditional rule-based monitoring cannot detect.

Instead of reviewing individual transactions, analysts see clusters, hubs, and hidden connections, turning complexity into structured insight.

Risk Scoring & Case Prioritization

High alert volumes require structured prioritization. An advanced AML risk scoring platform provides:

- Dynamic risk scoring based on multi-factor inputs

- High-value alert ranking

- Escalation triggers for high-impact networks

Risk scoring models consider:

- Transaction frequency and velocity

- Cross-border exposure

- Network centrality

- Historical enforcement flags

- Beneficial ownership risk indicators

Rather than processing STRs chronologically, investigators can focus on high-risk entities and networks first. This transforms enforcement from reactive screening to intelligence-driven prioritization.

Pattern & Anomaly Detection

Beyond static rules, AI-based AML detection identifies complex patterns and irregularities.

Capabilities include:

- Trade-based money laundering indicators

- Transaction velocity anomalies

- Cross-border fund flow irregularities

- Structuring and smurfing patterns

- Sudden behaviour shifts within dormant accounts

Adaptive analytics allow systems to detect evolving laundering techniques without relying solely on predefined thresholds.

This is particularly critical as financial crime methods continuously adapt to bypass rule-based controls.

Investigation Workflow Management

Detection alone is insufficient. Enforcement requires structured case development.

Modern AML investigation software supports:

- Case building and documentation

- Evidence correlation across datasets

- Timeline visualization of fund movement

- Inter-agency collaboration dashboards

- Audit-ready reporting formats

Investigators can trace funds from origin to final beneficiary, document linkages, and generate structured intelligence reports suitable for prosecution or regulatory escalation.

This closes the gap between analytics and legal action.

Use-Case Scenarios in AML Enforcement

The true value of a financial intelligence platform is visible in real-world enforcement workflows.

Detecting Mule Account Networks

Mule accounts are frequently used to fragment transactions and obscure fund origins. A financial intelligence platform can:

- Identify clusters of low-balance accounts with similar transaction patterns

- Detect synchronized transaction timing across accounts

- Trace funds flowing into high-value aggregator accounts

Network visualization reveals whether multiple accounts are acting as feeders to a central laundering node. This enables enforcement agencies to disrupt the broader structure rather than freeze individual accounts in isolation.

Exposing Shell Company Structures

Shell companies are often used to mask beneficial ownership. Using graph analytics, investigators can:

- Link directors across multiple entities

- Identify shared addresses or contact information

- Map layered fund transfers between corporate accounts

- Reveal ultimate beneficial ownership patterns

This is particularly valuable when shell entities operate across jurisdictions. Instead of reviewing corporate records manually, investigators can uncover hidden linkages at scale.

Trade-Based Money Laundering Detection

Trade-based money laundering often involves invoice manipulation and cross-border routing. Advanced analytics can:

- Identify invoice-value mismatches

- Flag abnormal trade flows inconsistent with historical patterns

- Detect round-tripping schemes

- Correlate customs data with financial transactions

By integrating trade and financial data, enforcement agencies can move beyond surface-level compliance review and identify structured laundering mechanisms.

STR Prioritization for FIUs

Financial Intelligence Units often receive thousands of STRs. A financial intelligence platform enables:

- Ranking reports based on network risk exposure

- Clustering related STRs into unified cases

- Reducing manual screening load

- Focusing investigator attention on high-impact networks

Rather than reviewing reports sequentially, FIUs can prioritize strategically, improving both speed and impact.

Measurable Impact on AML Enforcement

When deployed effectively, financial intelligence platforms support tangible enforcement outcomes. Credible benefits include:

- Reduced investigation time through automated correlation

- Improved detection of complex, multi-layered laundering structures

- Better STR prioritization based on network risk

- Increased inter-agency coordination through shared intelligence views

- Data-backed prosecution support with structured evidence trails

- Improved quality of regulatory and enforcement reporting

Importantly, the impact is enforcement-oriented. The objective is not simply to generate more alerts. It is to uncover hidden financial ecosystems, prioritize high-risk networks, and strengthen investigative outcomes.

For AML enforcement agencies, the transition from rule-based monitoring to intelligence-driven financial analysis represents a structural shift, one that aligns detection capabilities with the complexity of modern financial crime.

Conclusion

AML enforcement has evolved beyond threshold-based alert monitoring. As financial crime networks grow more layered, cross-border, and structurally complex, enforcement agencies require more than compliance dashboards, they require intelligence infrastructure.

Financial intelligence platforms bridge the gap between suspicious transaction reporting and actionable investigation. By integrating multi-source data, applying network analytics, prioritizing high-risk cases, and supporting structured case development, they transform fragmented financial signals into enforceable insight.

For financial intelligence units and enforcement agencies, the shift is clear: from reviewing transactions to mapping financial ecosystems, and from reactive compliance to proactive AML enforcement.

Frequently Asked Questions (FAQs)

1. What is a financial intelligence platform?

A financial intelligence platform is an integrated analytics system that consolidates transaction data, STRs, entity records, and intelligence inputs to support AML investigations.

2. How is a financial intelligence platform different from AML software?

Traditional AML software focuses on rule-based alert generation for compliance. Financial intelligence platforms focus on network analysis and investigative intelligence.

3. Can AI detect money laundering?

AI can detect patterns, anomalies, and network structures indicative of laundering, but human investigators validate and act on findings.

4. What is AML network analysis?

AML network analysis uses graph analytics to identify relationships between accounts, companies, and individuals involved in financial crime.

5. How do FIUs prioritize suspicious transaction reports?

Advanced platforms rank STRs based on network risk, transaction behaviour, and linked entity exposure rather than reviewing them sequentially.

6. Why is graph analytics important in financial crime detection?

Graph analytics reveals hidden connections, beneficial ownership patterns, and circular fund flows that rule-based systems may miss.

7. Does a financial intelligence platform improve prosecution outcomes?

Yes. Structured evidence trails, timeline visualization, and linked entity documentation support stronger enforcement and regulatory action.