Modern financial crimes generate massive volumes of transactional and entity data. The real challenge for financial intelligence agencies is not access to information, but the ability to convert fragmented financial data into timely, actionable insights.

Intelligence-led financial analysis enables investigators to move beyond isolated transactions and understand the broader financial behaviour, hidden linkages, and intent behind complex economic offences.

Understanding Intelligence-Led Financial Analysis

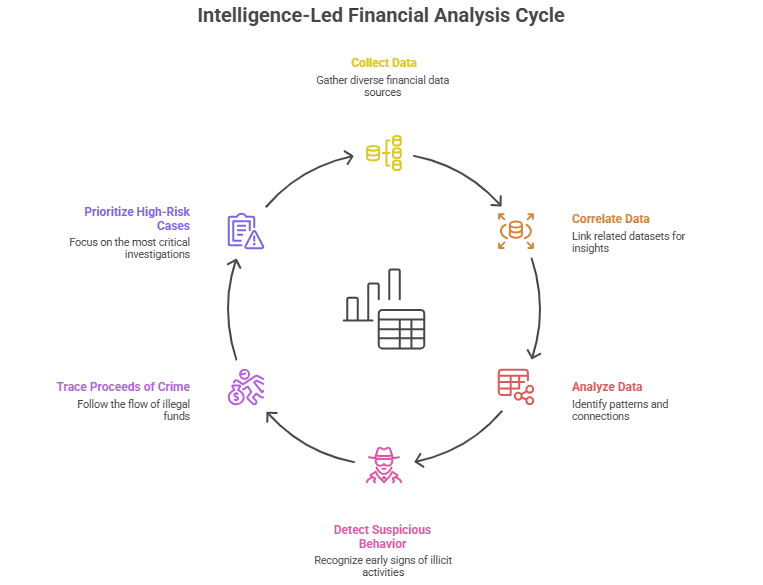

Intelligence-led financial analysis refers to the structured process of collecting, correlating, and analysing financial data to support detection, investigation, and enforcement actions.

It brings together multiple data sources such as banking transactions, corporate ownership records, tax-related data, and case-specific inputs. When analysed in isolation, these datasets offer limited value. When correlated and contextualised, they reveal meaningful patterns and connections.

This approach allows agencies to identify suspicious behaviour early, trace proceeds of crime, and prioritise high-risk cases.

Why Intelligence-Led Analysis Is Critical for Complex Investigations

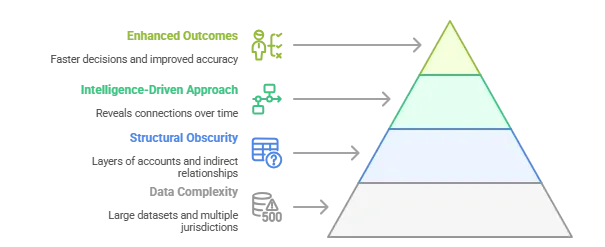

Economic offences are rarely linear. They are deliberately structured through layers of accounts, intermediary entities, and indirect relationships designed to obscure accountability.

An intelligence-driven approach helps agencies uncover these structures by revealing how individuals, entities, and transactions are connected over time. It supports faster decision-making, improves investigation accuracy, and strengthens evidentiary foundations.

This capability becomes especially important in cases involving large datasets, multiple jurisdictions, or long transaction histories.

Key Challenges in Traditional Financial Analysis

Many investigative teams still rely on manual or semi-automated processes. Financial data often exists in different formats and systems, requiring extensive effort to clean and reconcile. Visualising complex transaction networks using spreadsheets is difficult, and identifying priority leads becomes time-consuming as case volumes increase.

These limitations slow investigations and increase the risk of missing critical connections.

How AI Strengthens Financial Intelligence Capabilities

Artificial Intelligence enables a shift from manual analysis to insight-driven investigations.

AI-powered platforms automate data ingestion, intelligently resolve duplicate or alias identities, and detect anomalous transaction patterns. Graph analytics visualises relationships between accounts and entities, allowing investigators to see entire financial networks rather than individual transactions.

This reduces manual effort and enables investigators to focus on decision-making rather than data preparation.

Intelligence as the Foundation for Fund Trail Analysis

Accurate fund trail analysis depends on strong underlying intelligence.

Clean, correlated datasets and clear entity resolution are essential to reliably trace the movement of funds from source to destination. Intelligence-led analysis provides the context needed to interpret transaction behaviour, identify layering mechanisms, and establish defensible financial linkages.

For a deeper understanding, read our detailed guide on fund trail analysis.

In short, Intelligence-led financial analysis has become central to modern financial investigations. As economic offences grow more sophisticated, agencies require analytical capabilities that transform raw financial data into actionable insights.

AI-driven intelligence platforms enable faster investigations, clearer visibility into complex networks, and stronger case outcomes. They also lay the groundwork for advanced capabilities such as fund trail analysis, network discovery, and evidence-backed enforcement.