Why Anti Money Laundering Software Matters Today

In 2024, global watchdogs estimated that over $2 trillion is laundered through the financial system every year – much of it funding organized crime, terrorism, and corruption. Traditional manual reviews, no matter how meticulous, cannot keep pace with the sheer scale and sophistication of modern laundering schemes. From shell companies in tax havens to crypto tumblers on the dark web, illicit finance is evolving faster than human analysts can track.

This is where Anti-Money Laundering (AML) software steps in. More than just a compliance tool, it has become the backbone of financial defence, enabling banks, fintechs, insurers, regulators, and even cryptocurrency exchanges to spot suspicious activity in real time, reduce false positives, and meet stringent global regulations.

Unlike static checklists of the past, today’s AML software blends transaction monitoring, entity resolution, AI-driven link analysis, and automated reporting into one unified platform. For financial institutions under pressure to stop money laundering before it enters the economy, AML software is no longer optional, it’s mission-critical.

What is Anti-Money Laundering Software?

At its core, Anti Money Laundering Software is a digital solution that helps financial institutions and regulators detect, prevent, and report suspicious financial activity. Instead of relying on manual reviews of endless transactions, AML software automates the process by monitoring patterns, flagging anomalies, and ensuring compliance with global regulations.

But Anti Money Laundering Software is more than just a compliance checkbox. It works as an intelligence engine inside financial systems, connecting the dots between customers, accounts, and transactions.

Key functions include:

- Transaction Monitoring – Tracking financial flows in real time to detect unusual activities (e.g., sudden large transfers, frequent cross-border movements).

- KYC and Customer Due Diligence – Verifying customer identities, screening against sanctions lists, and ensuring ongoing monitoring of high-risk individuals or entities.

- Entity Resolution & Link Analysis – Identifying hidden connections between individuals, businesses, and networks that could indicate laundering rings.

- Automated Reporting – Generating Suspicious Activity Reports (SARs) and other regulatory filings quickly and accurately.

👉 Think of Anti-Money Laundering Software as the radar system of the financial world, constantly scanning for threats that are invisible to the human eye, while ensuring institutions remain compliant with laws like FATF guidelines, EU AML directives, and national regulations.

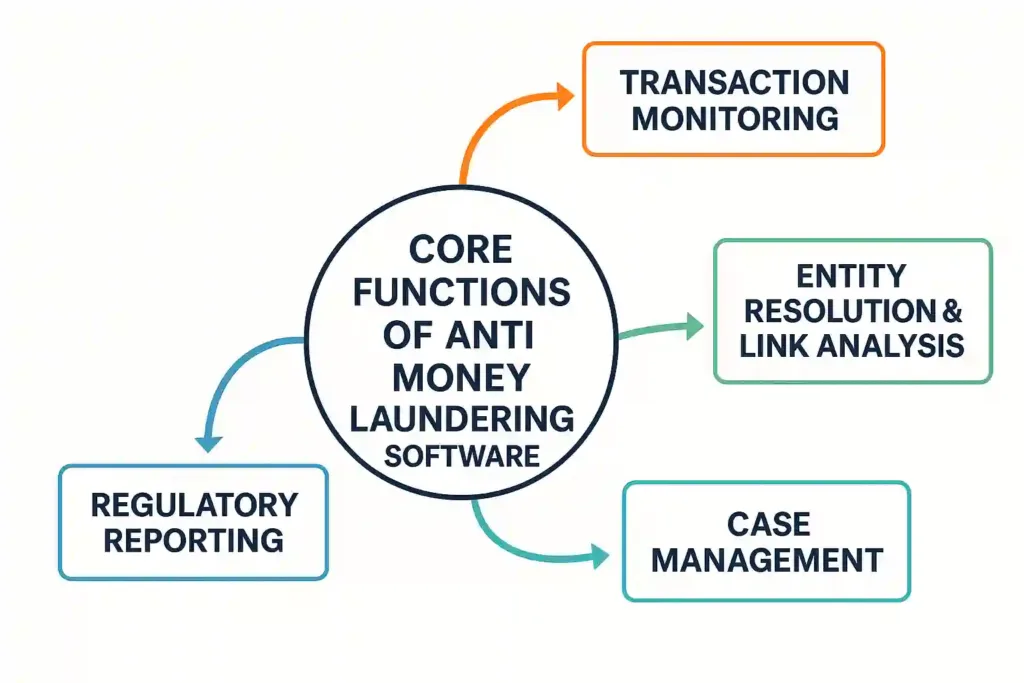

Core Functions of Anti Money Laundering Software

To understand why Anti Money Laundering Software is indispensable, it helps to look at its core functions, the features that make it the backbone of modern financial crime prevention.

Transaction Monitoring

- Rule-Based Detection: Traditional systems flag activities based on pre-set thresholds (e.g., cash deposits above ₹10 lakh, multiple high-value transfers within a short span).

- AI-Driven Detection: Advanced AML software uses machine learning to identify unusual patterns, for example, a sudden shift in a customer’s transaction behaviour or layering attempts across multiple jurisdictions.

👉 This ensures fewer false positives and faster detection of genuine risks.

Entity Resolution & Link Analysis

Criminal networks rarely operate in isolation. They use shell companies, proxies, and layered ownership to mask true beneficiaries.

- Entity Resolution: Combines fragmented records across databases to build a single, unified view of customers.

- Link Analysis: Maps out hidden connections between accounts, businesses, and individuals, exposing laundering rings and cross-border networks.

👉 Example: Detecting that three unrelated accounts, spread across different banks, are funnelling funds to the same offshore entity.

Case Management

Once suspicious activity is flagged, investigators need a structured way to act.

- Centralized case files bring together transactions, documents, and risk scores.

- Audit trails track every step for transparency and accountability.

- Integrated alerts and workflows make it easier for compliance teams to collaborate and close cases quickly.

👉 This transforms AML from a fragmented process into an organized investigative workflow.

Regulatory Reporting

Compliance isn’t just about detection – it’s also about documentation.

- AML software generates Suspicious Transaction Reports (STRs), Suspicious Activity Reports (SARs), and other regulatory filings in the required formats.

- Automatic filing ensures speed and accuracy, reducing the risk of penalties for late or incorrect reporting.

👉 For financial institutions, this means peace of mind when dealing with regulators.

In short, AML software integrates detection, investigation, and reporting into one seamless ecosystem, ensuring both compliance and proactive financial crime defence.

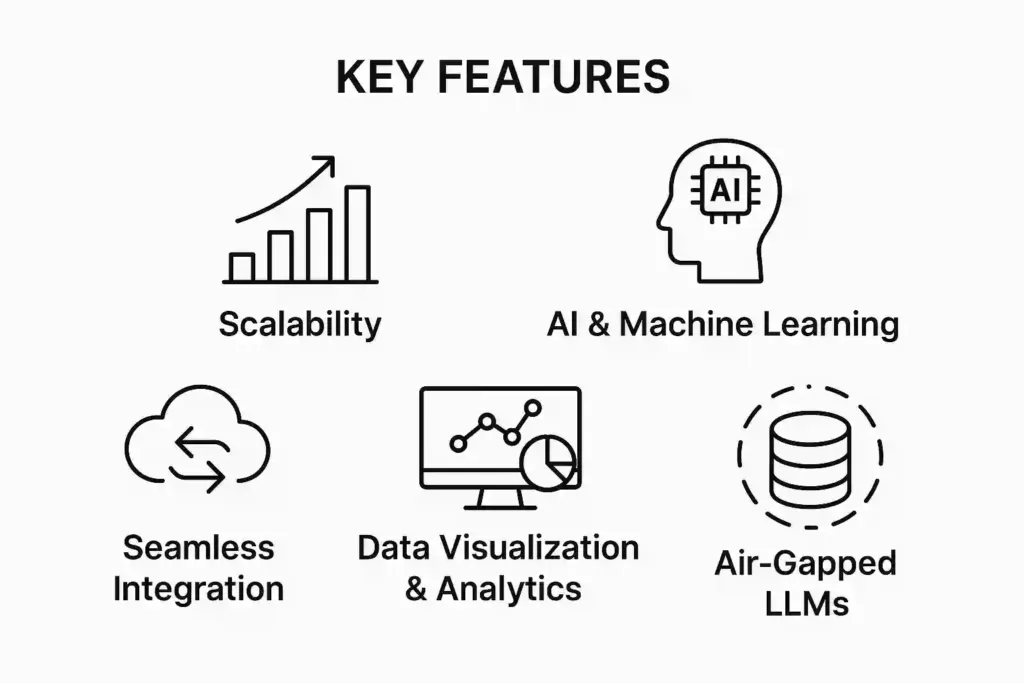

Key Features That Define the Best Anti Money Laundering Software

Not all Anti Money Laundering Software are built the same. Financial institutions today handle millions of transactions across banking, fintech, and even digital assets.

To keep up, the best AML software offers scalability, intelligence, and adaptability while staying compliant with evolving regulations.

Here are the key features that matter most:

Scalability

- The financial ecosystem is high-volume and real-time.

- A strong AML solution must process millions of transactions per day without bottlenecks.

- Whether it’s a traditional bank, a payment gateway, or a crypto exchange, scalability ensures that monitoring remains seamless even as transaction volumes surge.

AI & Machine Learning

- Legacy systems generate too many false positives, overwhelming compliance teams.

- AI-driven AML tools learn from historical cases and adapt to emerging patterns.

- This leads to more accurate detection, prioritizing high-risk activities while filtering out noise.

👉 Predictive AML tools also allow institutions to anticipate suspicious behaviour before it escalates.

Seamless Integration

- Modern financial crime doesn’t stop at banking. Laundering routes often span fintech apps, remittance networks, and digital currencies.

- The best AML software integrates with:

- Core banking systems

- API-driven fintech platforms

- Crypto exchange monitoring tools

- This unified view reduces blind spots and makes compliance more comprehensive.

Data Visualization & Analytics

- Investigators need more than alerts, they need clarity.

- Graphs, dashboards, and link analysis maps help visualize relationships between entities, transactions, and jurisdictions.

- This makes it easier to spot hidden networks, unusual flows, and repeat laundering structures at a glance.

Air-Gapped LLMs for Analyst-Friendly Reporting

- AML analysts often deal with large, unstructured datasets.

- Safe, air-gapped Large Language Models (LLMs) can transform this complexity into:

- Summarized reports

- Narrative timelines

- Court-ready documentation

- This reduces cognitive overload while keeping sensitive data secure within institutional boundaries.

✅ In short, the best AML software combines predictive analytics, seamless integrations, and intuitive reporting, enabling institutions to move from reactive compliance to proactive financial crime defence.

Benefits of Anti Money Laundering Software for Institutions

For financial institutions, compliance is no longer just a box-ticking exercise. Regulators are raising expectations, criminals are innovating faster, and transaction ecosystems are becoming borderless.

This makes AML compliance software a critical investment for banks, fintechs, and regulators alike.

Here are the core benefits:

Faster Detection of Suspicious Activity

- Real-time monitoring ensures that red flags are raised instantly.

- Instead of discovering money laundering weeks after it happens, institutions can stop suspicious activity mid-flow.

- This helps prevent reputational damage, financial losses, and regulatory penalties.

Reduced Compliance Costs & Human Error

- Manual compliance teams often struggle with huge data volumes.

- By automating sanctions screening, transaction monitoring, and reporting, AML software reduces reliance on large compliance departments.

- Lower false positives also mean less wasted time on irrelevant alerts.

Improved Risk Scoring & Customer Profiling

- Not every transaction poses the same risk.

- AML solutions apply risk-based scoring to customers, accounts, and transactions.

- This allows institutions to focus resources where they matter most, high-risk individuals, entities, and jurisdictions.

Enhanced Collaboration with Regulators

- Most regulators now expect standardized digital reporting, such as Suspicious Transaction Reports (STRs).

- AML software ensures these reports are generated automatically, in the right format, and on time.

- This improves transparency and fosters trust between institutions and regulators.

Future-Readiness for Crypto & Fintech

- Money laundering no longer hides only in traditional banking channels.

- Today’s threats extend to cryptocurrency exchanges, decentralized finance (DeFi), online gaming, and fintech apps.

- Advanced AML risk management platforms are already integrating with crypto monitoring tools and fintech APIs, ensuring institutions remain ahead of new laundering typologies.

✅ With these benefits, AML compliance software transforms from a regulatory burden into a strategic shield, protecting financial institutions from both criminal networks and costly compliance failures.

Evaluating Anti Money Laundering Software – What to Look For

Choosing the right AML compliance solution is not just about ticking off features, it’s about ensuring long-term resilience against evolving threats. With multiple vendors in the market, financial institutions must evaluate solutions carefully. Here are the key considerations:

Compliance Coverage Across Jurisdictions

- AML regulations differ across countries and regions, from FATF (Financial Action Task Force) guidelines to the EU Anti-Money Laundering Directives (AMLD), and US FinCEN requirements.

- The best AML software provides multi-jurisdictional compliance coverage, ensuring you remain aligned globally, even if your institution operates in multiple geographies.

Ease of Integration with Legacy Systems

- Many banks and financial institutions still rely on legacy systems for core operations.

- An AML solution must offer seamless integration via APIs or connectors, minimizing disruption while enabling interoperability with existing data sources.

Flexibility for Cross-Border Operations

- Laundering rarely respects borders. Funds often move across multiple countries and regulatory environments.

- AML compliance software should support multi-currency, multi-language, and cross-border monitoring, so suspicious activity doesn’t slip through simply because it changes jurisdictions.

Data Privacy & On-Premise Security

- With financial data being highly sensitive, privacy and security must be non-negotiable.

- Institutions should look for vendors that support on-premise deployments, strong encryption, and compliance with data protection frameworks (GDPR, HIPAA where applicable).

- Air-gapped or private-cloud capabilities can further protect against cyber threats while keeping regulators satisfied.

✅ In short, choosing AML software requires balancing regulatory compliance, integration ease, operational flexibility, and robust data protection. The right platform ensures not only compliance but also strategic readiness against modern laundering threats.

Innefu’s Edge in Anti Money Laundering Software

While many AML platforms focus solely on compliance checklists, the next generation of solutions must go further – enabling financial institutions to outpace laundering tactics, not just respond to them.

This is where Innefu’s Prophecy Eagle I provides a distinct advantage:

AI-Driven AML Transaction Monitoring

Goes beyond static rule-based alerts with adaptive machine learning models that detect unusual behaviours, reducing false positives while surfacing genuinely suspicious activity.

Entity Resolution & Link Analysis

Criminals often hide behind networks of shell companies and layered transactions. Prophecy Eagle I uncovers these hidden connections, enabling investigators to see the bigger picture of financial crime networks.

Complex Typology Detection

Whether it’s trade-based laundering, smurfing, or crypto mixing, the system is designed to flag intricate laundering typologies that conventional monitoring often misses.

On-Premise LLM Capabilities

Secure, air-gapped language models help analysts generate summaries, suspicious activity reports (SARs/STRs), and case briefs, without ever compromising sensitive financial data.

With these capabilities, Innefu positions itself not just as a provider of AML compliance software, but as a strategic intelligence partner, empowering institutions to defend against both financial crime and its broader national security implications.

The Future of Anti Money Laundering Software

As financial crimes become more sophisticated, spanning crypto exchanges, global trade, and digital banking, compliance alone is no longer enough. Institutions need intelligence-driven AML software that combines regulatory adherence with proactive detection.

Solutions like Innefu’s Prophecy Eagle I represent this shift: platforms that don’t just tick compliance boxes, but actively empower investigators, reduce risks, and build long-term resilience against money laundering and terror financing.

In the years ahead, AML will be defined by those who move fastest – with AI-powered, adaptive platforms becoming the first line of defence for financial institutions worldwide.

FAQs Section

Q1. What is AML software used for?

AML software helps financial institutions detect, monitor, and report suspicious financial activity. It ensures compliance with regulations while uncovering hidden networks of money laundering.

Q2. How does AML transaction monitoring work?

It tracks customer transactions in real-time, using rules, behaviour analytics, and AI models to flag unusual patterns that may indicate money laundering or terror financing.

Q3. What are the key features of the best AML software?

Scalability, AI/ML-powered detection, entity resolution, link analysis, integration with banking systems, and secure reporting tools like air-gapped LLMs.

Q4. Why is AML software important for banks and fintechs?

It reduces compliance risks, prevents financial crime, saves costs by minimizing false positives, and helps institutions build trust with regulators and customers.

Q5. How is Innefu’s Prophecy Eagle I different from other AML solutions?

Prophecy Eagle I goes beyond compliance by offering AI-driven AML monitoring, advanced link analysis, entity resolution, and secure on-premise reporting, making it a true intelligence partner for institutions.

Q6. Can AML software handle cryptocurrency transactions?

Yes. Advanced AML platforms incorporate crypto wallet monitoring and blockchain analysis, enabling them to detect laundering through digital assets.