BFSI

Empowering Banks, NBFCs and Insurance Firms with AI-driven Fraud Detection

Redefining Risk, Compliance & Intelligence for Modern Financial Institutions

The Financial Ecosystem is Evolving

Is Your Risk Framework Evolving With It?

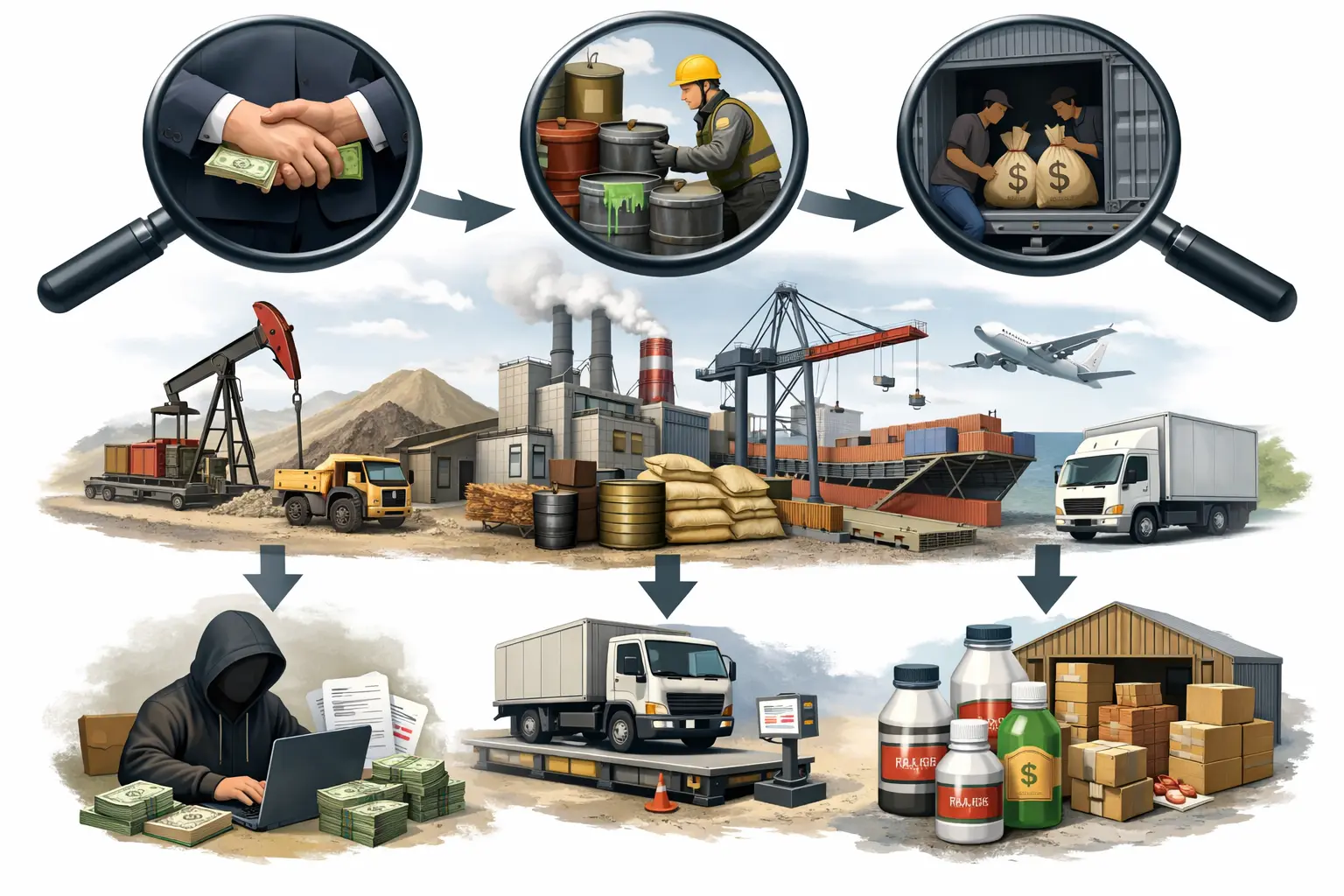

In today’s hyperconnected financial landscape, fraudsters are getting smarter, and the threats more subtle. From synthetic identities to cyber-enabled mule accounts, institutions must outpace adversaries with intelligence that’s faster, sharper, and predictive.

Synthetic Identity Fraud

Indian banks face a silent but severe threat—over 95% of synthetic identities slip through onboarding undetected. These fake personas blend real and fabricated data, bypassing traditional checks. AI-driven identity intelligence is essential to unmask synthetic IDs and bridge institutional data silos.

Vendor & Client Due Diligence Gaps

Third-party vendors and clients often operate in the blind spots of compliance frameworks. Inadequate due diligence and the absence of 360-degree continuous monitoring leave banks vulnerable to reputational, operational, and regulatory risks.

Mule Accounts Proliferation

Mule accounts—used to launder stolen or illicit funds—remain a serious concern. Nearly 60% of financial cybercrime in India is linked to such accounts. These sleeper accounts bypass manual scrutiny and are often activated during cyber heists or fraud events.

Stay One Step Ahead with Innefu’s AI-Driven Risk & Fraud Intelligence Suite

Innefu empowers banks, NBFCs, and insurers to move from reactive checks to real-time risk mitigation. Our platform brings together AI, analytics, and automation to detect fraud, assess third-party risk, and ensure regulatory compliance — all from a unified, intelligent command center.

Fraud Detection & Synthetic Identity Analysis

Leverage behavioral biometrics, document verification, and network patterning to flag synthetic IDs, duplicate accounts, and identity manipulation.

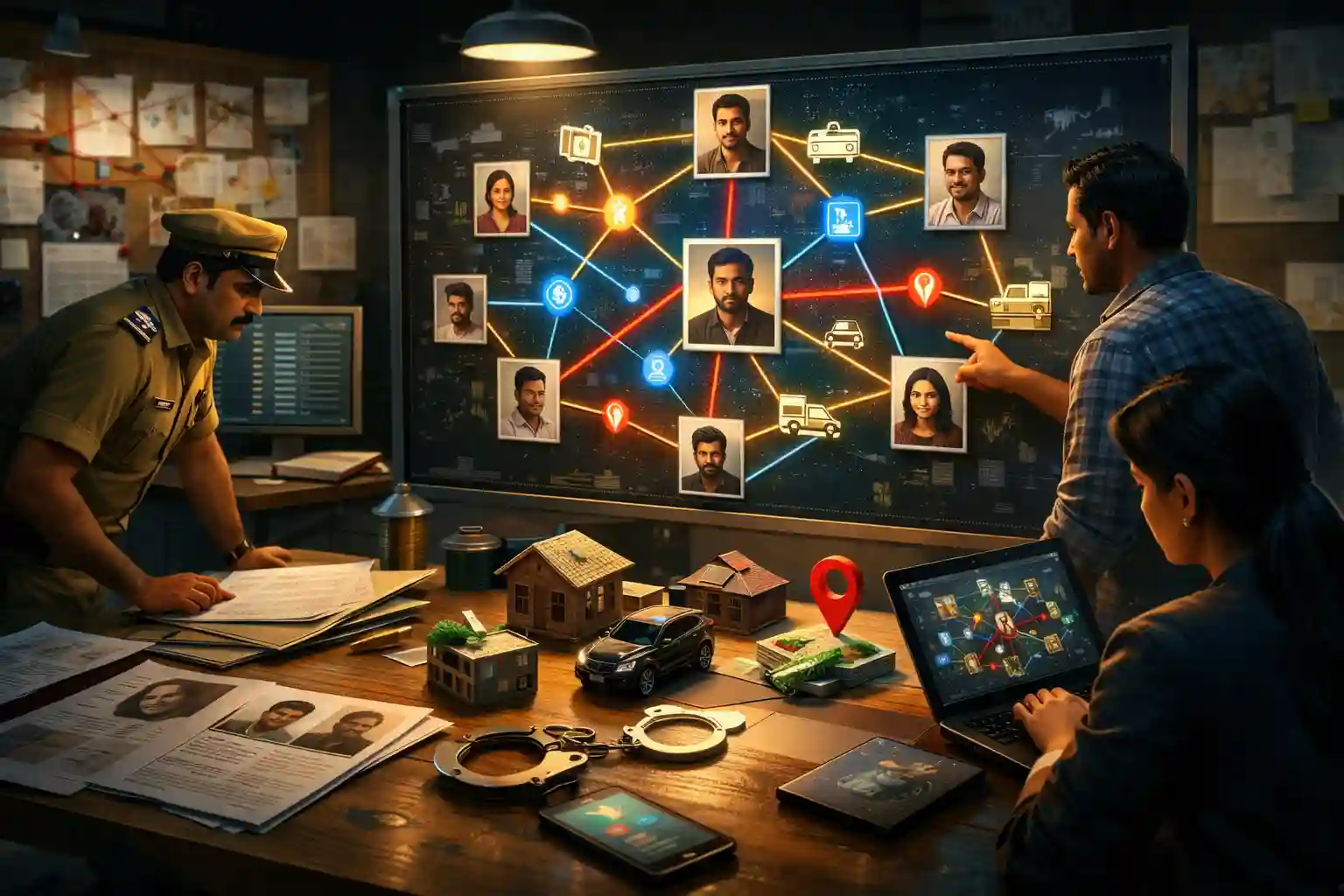

Mule Account Detection

Ingest payment, location, and device data to identify dormant accounts with fraud-linked characteristics before they are activated.

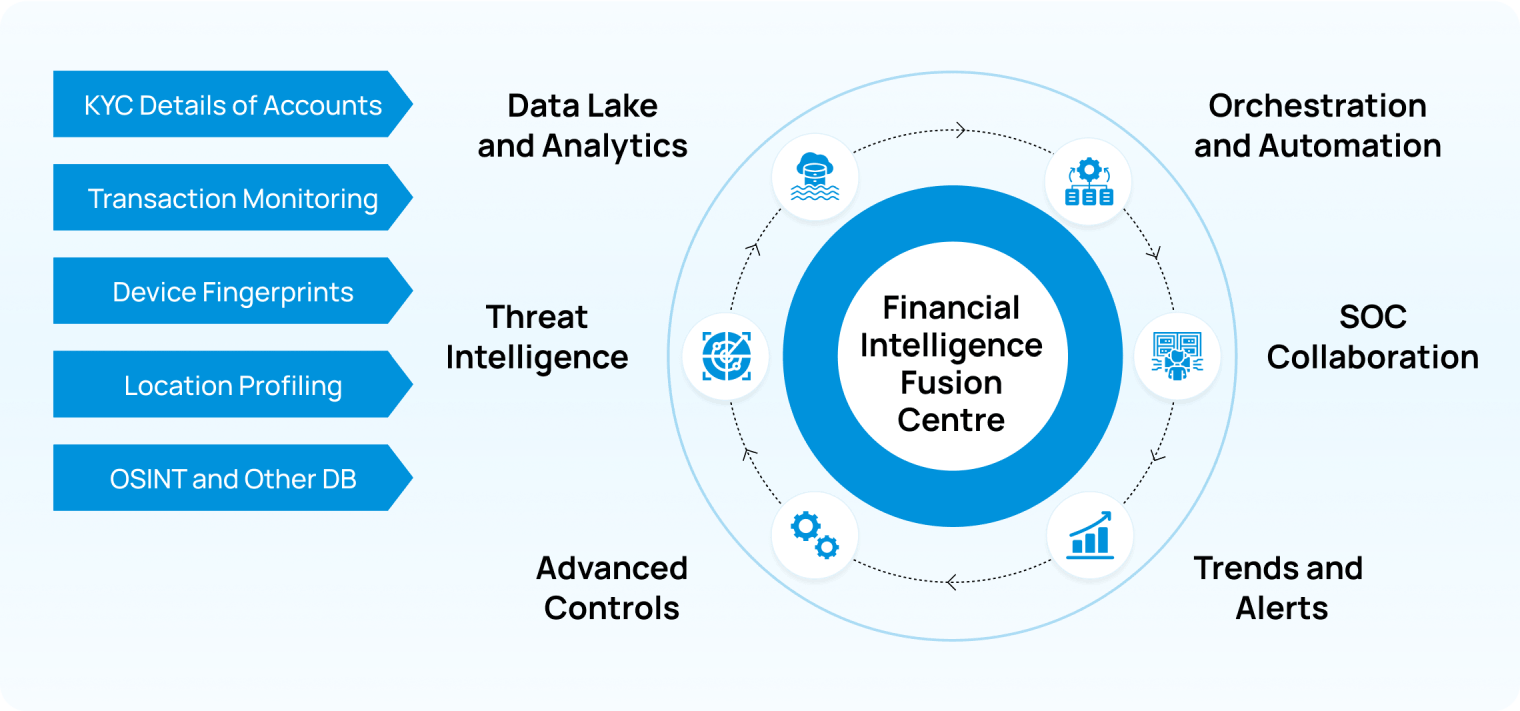

KYC & AML Automation

Enrich customer profiles with intelligent document processing, real-time verification, and adverse media screening to ensure compliance with evolving RBI and FATF norms.

Cybersecurity & Insider Risk Monitoring

Real-time surveillance of internal users, endpoints, and high-risk behavior to prevent data exfiltration and insider fraud.

Vendor & Client Risk Profiling

Score third parties continuously using alternate data, geo-intelligence, legal records, and transaction behavior to flag high-risk entities early.

360° Customer Risk Engine

Unify fragmented data—loan history, interactions, complaints, social signals—into a single risk dashboard for each customer or entity.

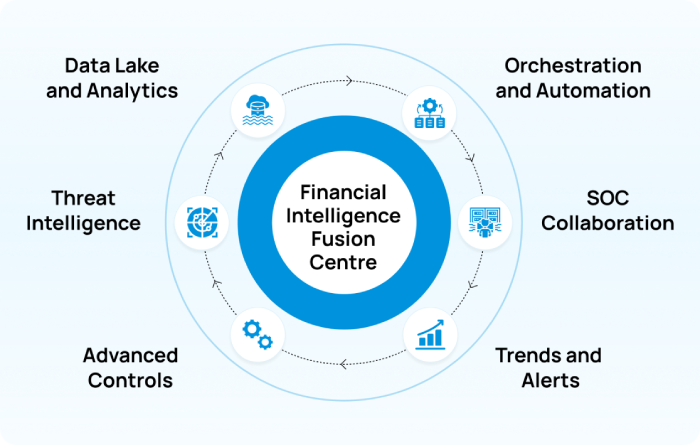

Financial Intelligence Fusion Centre

A command centre for BFSI players that fuses KYC, AML, fraud detection, cyber intelligence, and regulatory compliance into one intelligent platform.

Use Cases Across BFSI Functions

- Synthetic ID & Onboarding Fraud Prevention

- Early Warning System for Loan Delinquency

- AML & Continuous KYC Monitoring

- Insider Threat & Data Leak Protection

- Vendor and Third-Party Risk Intelligence

- Card Transaction & Payment Fraud Detection

- Cybercrime-linked Account (Mule) Identification

Why BFSI Leaders Choose Innefu?

Deployed across top banks, NBFCs, and insurance firms in India

Reduction in fraud-linked operational losses

Modular, scalable architecture for phased digital transformation