Transform Financial Fraud Investigations

with Advanced Analytics

AI-Powered Financial Intelligence Fusion Centre

Financial Fraud Detection with AI-Driven Intelligence

Prophecy Eagle I is an AI-powered Financial Fusion Centre that helps enforcement agencies combat tax evasion, money laundering, and shell company fraud. By correlating data from GST filings, e-way bills, bank records, and more, it delivers actionable insights and automated risk assessment.

See it in Action

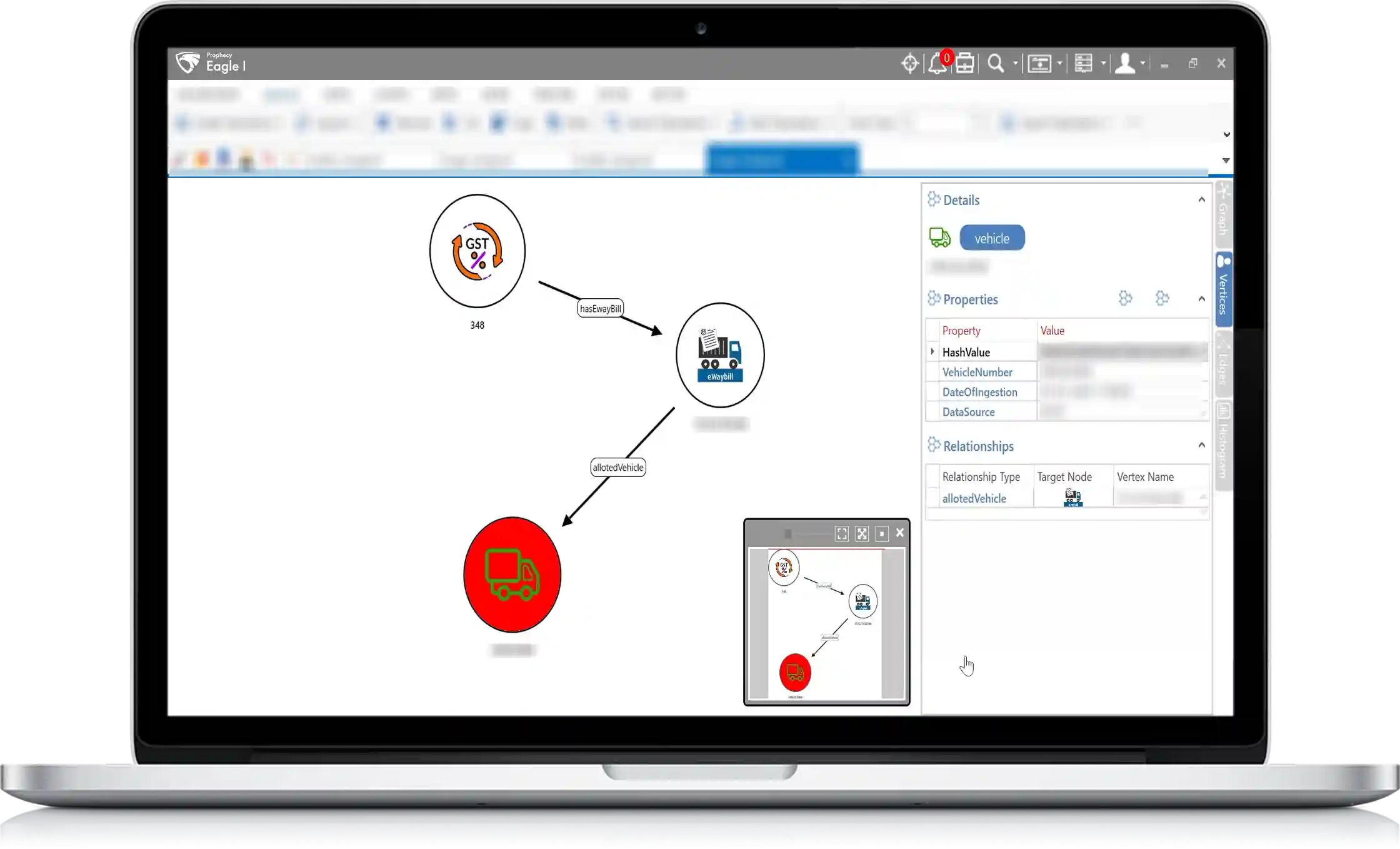

Financial Data Analytics

Integrate financial transaction data for cross-platform case analysis and fraud detection, enhanced with advanced analytics for deeper insights. Augmented with predictive models and link analysis to uncover anomalies and connections in financial activity.

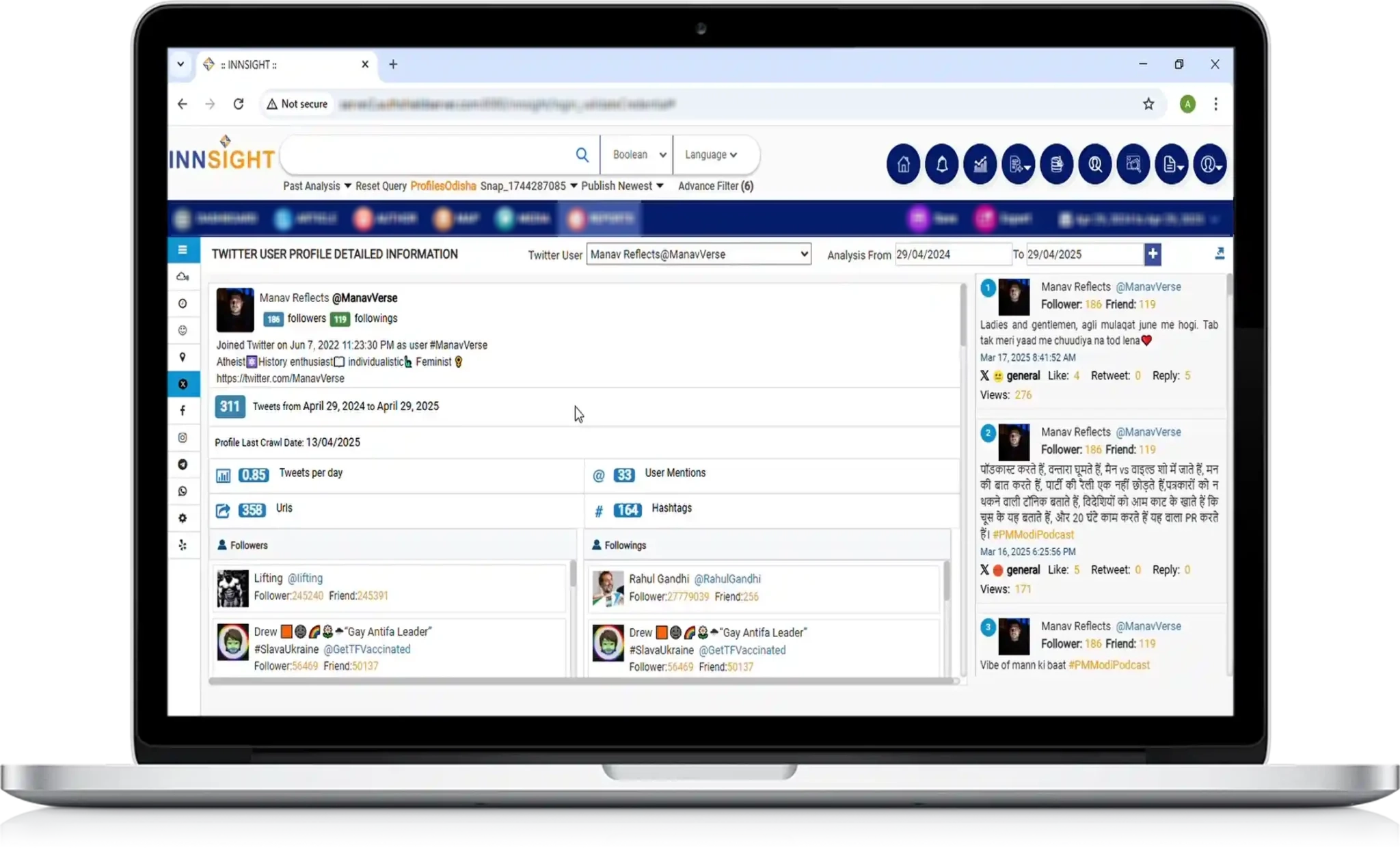

Vendor Client Due Diligence for Anti Money Laundering

INNSIGHT enables detailed reputation assessment by identifying blacklisted affiliations, analyzing online sentiment, and uncovering potential fraudulent links. It also scans the Surface and Deep Web to provide real-time threat scores for proactive risk evaluation.

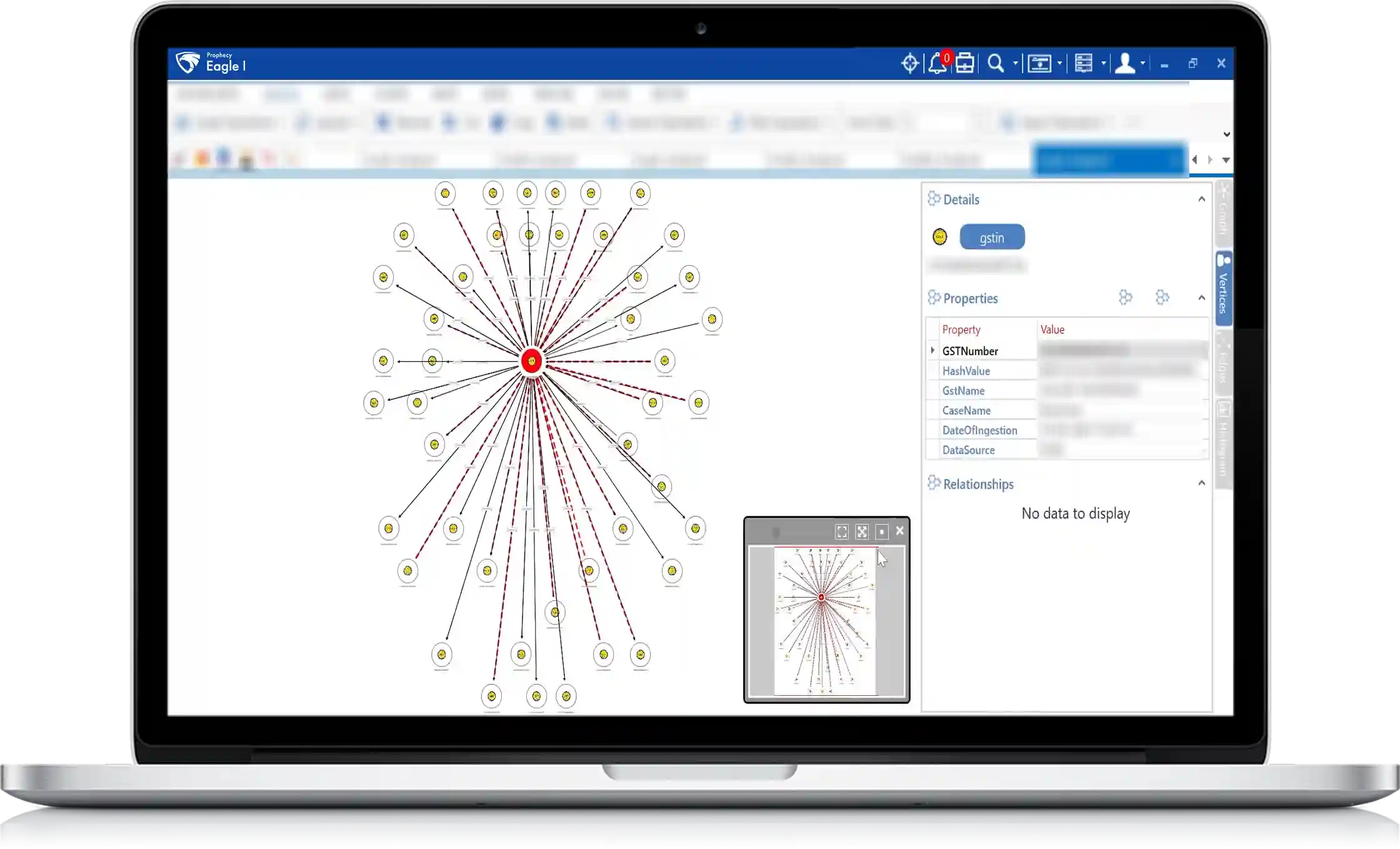

Threat Scoring of GST/Account

Threat scoring of GST/Account involves multi-layered risk assessment using facial biometrics, device fingerprints, IP analysis, and OSINT monitoring. It flags disposable numbers, breached emails, forged documents, and links to sanctioned entities to detect potential fraud.