Enabling Unified Financial Intelligence Across Complex Fraud Ecosystems

Financial fraud investigations rarely fail due to lack of data.

They fail because data remains fragmented across cases, systems, and time.

This case study demonstrates how unifying GST returns, HSN-level data, transaction trails, and supply chain signals transforms isolated fraud detection into ecosystem-level intelligence, revealing coordinated financial behaviour that remains invisible in case-by-case analysis.

At a Glance

- Cross-case analysis of multiple DGARM investigations

- Recurrent GSTIN clusters appearing across fraud typologies

- Unified view spanning ITC misuse, circular trade, and commodity diversion

Challenges

- Investigations conducted in case-specific silos

- Entity-level thresholds masking cumulative exposure

- Fraud behaviour distributed across multiple tax periods

- Limited correlation between GST returns, HSNs, and tracing outputs

Solution

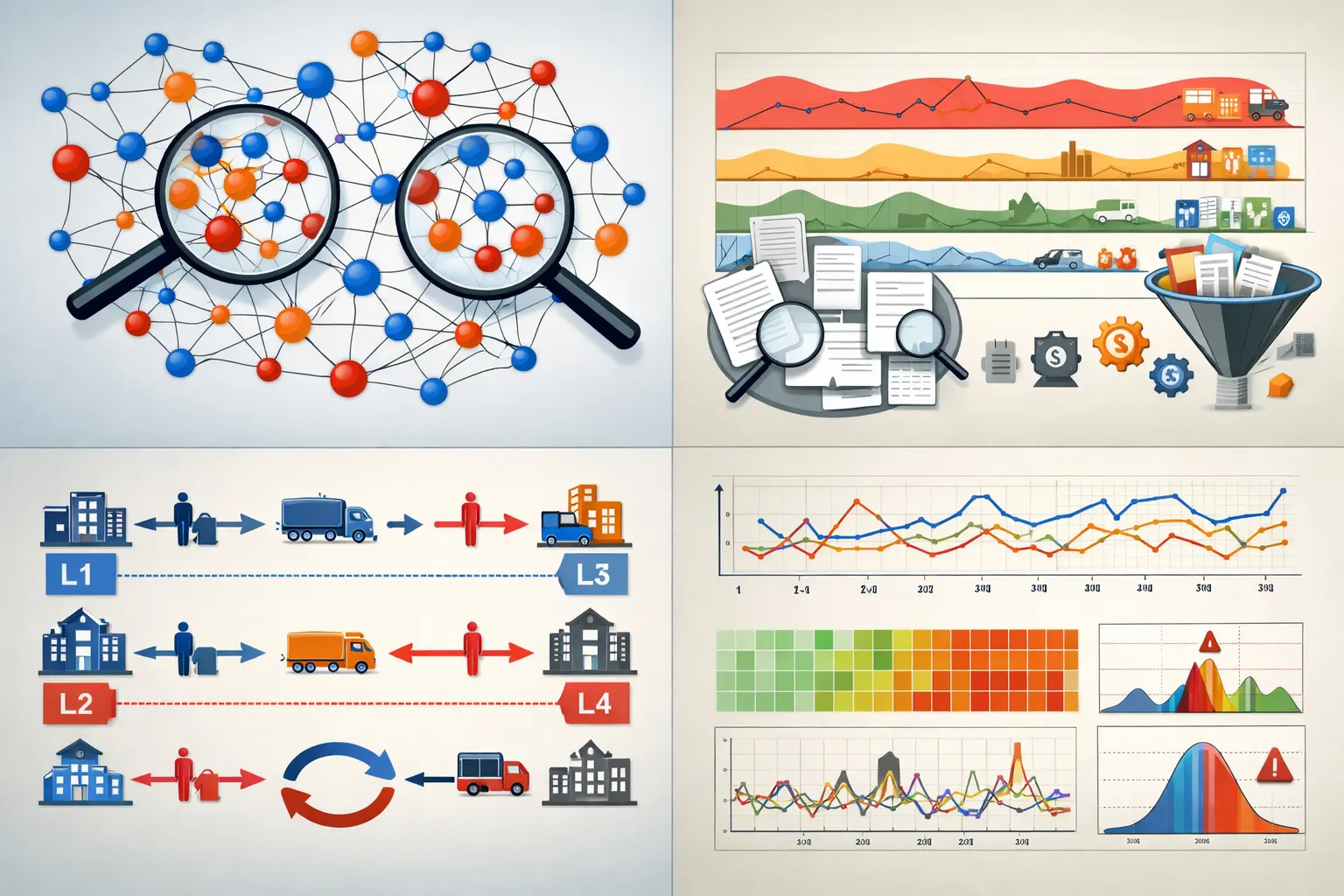

- Cross-case correlation of recurring GSTINs

- HSN-level continuity analysis across fraud typologies

- Forward and backward tracing (L1–L4) across multiple investigations

- Behavioural baselining beyond period-by-period review

Key Results

Cross-Case Network Visibility

Identified GSTIN clusters recurring across 3–4 distinct fraud typologies, revealing coordinated financial ecosystems.

Hidden Exposure Discovery

Uncovered aggregate exposure significantly exceeding what individual case reviews suggested.

Pattern-Led Detection

Connected ITC accumulation, circular trade, and commodity diversion into a single behavioural sequence.

Early Risk Identification

Enabled earlier detection of recurring entities and patterns before exposure scaled further.