Detecting Supply Chain Abuse in Regulated Commodities

Not all financial crime targets tax revenue directly.

Some of the most damaging abuse occurs when regulated and subsidised commodities are diverted away from their intended end use.

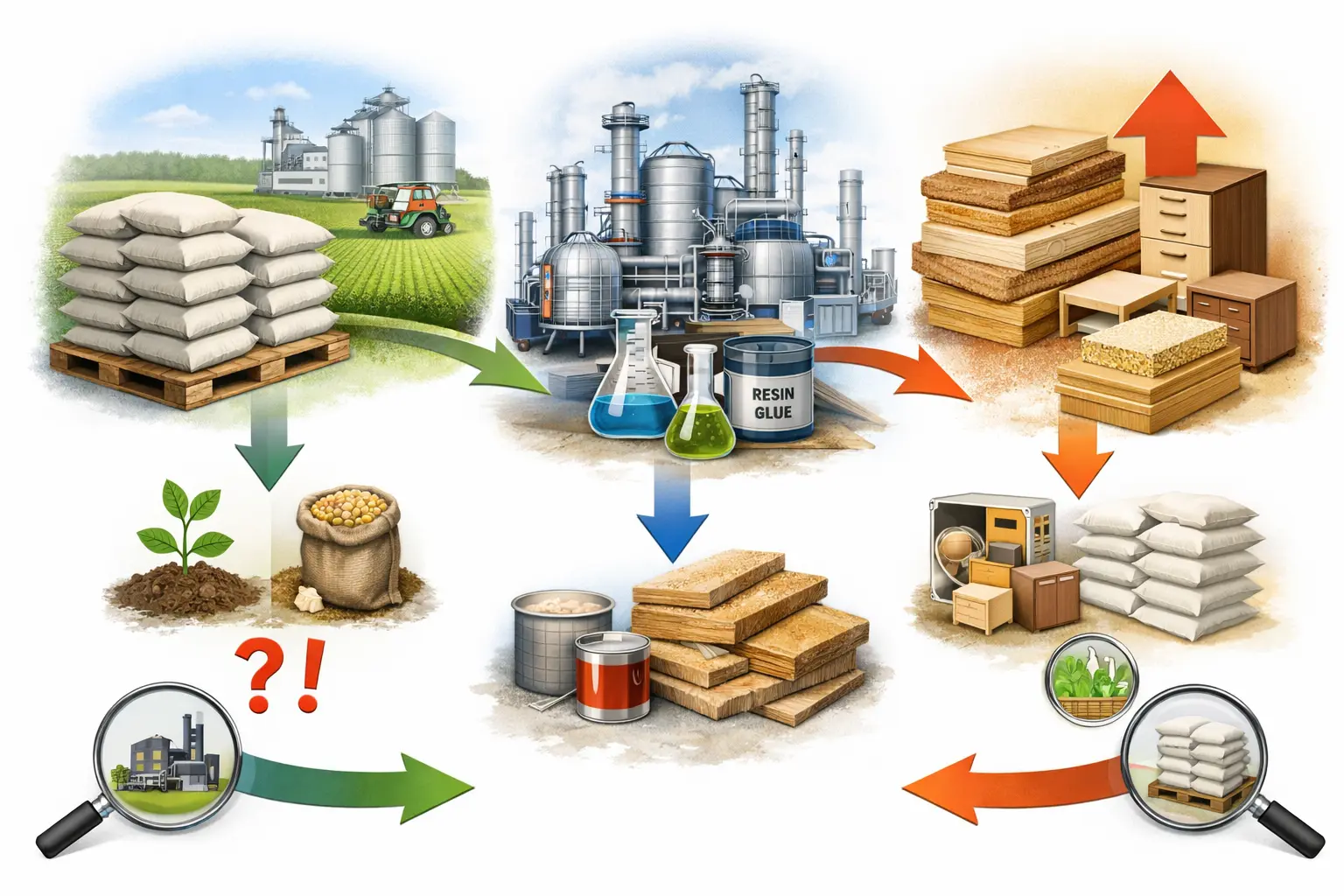

This case study examines how fertiliser-grade urea was systematically diverted into industrial production chains, distorting subsidy frameworks, market pricing, and policy intent, while remaining procedurally compliant on paper.

At a Glance

- Diversion of fertiliser-grade urea (HSN 3102) into UF resin manufacturing

- Conversion of subsidised inputs into industrial outputs (HSN 3909)

- End-use mismatch revealed through forward and backward tracing

Challenges

- Procedurally compliant invoices, GSTR-1, GSTR-3B, and e-way bills

- Multi-layered intermediary GSTINs fragmenting supply chain visibility

- End-use declarations masking actual chemical transformation

- Lack of linkage between subsidy allocation and downstream consumption

Solution

- Backward tracing to identify recurring upstream fertiliser suppliers

- Forward tracing (up to L4 buyers) to map downstream industrial usage

- HSN-level correlation between regulated inputs and manufactured outputs

- Detection of abnormal pricing and composition ratios inconsistent with declared use

Key Results

Commodity Diversion Detection

Identified systematic diversion of fertiliser-grade urea into urea–formaldehyde resin production chains.

Policy Impact Visibility

Revealed misuse of agricultural subsidies for industrial manufacturing and downstream commercial gain.

Market Distortion Insight

Detected UF resin supplied at abnormally low prices (below ₹21/kg), inconsistent with legitimate production economics.

End-Use Traceability

Established end-to-end traceability from subsidised input to downstream plywood and board manufacturing clusters.