Uncovering Circular Transactions Through HSN-Level Analysis

Not all suspicious trade activity results in immediate revenue loss.

Some fraud operates by circulating value within closed loops, creating compliant-looking transactions while obscuring intent.

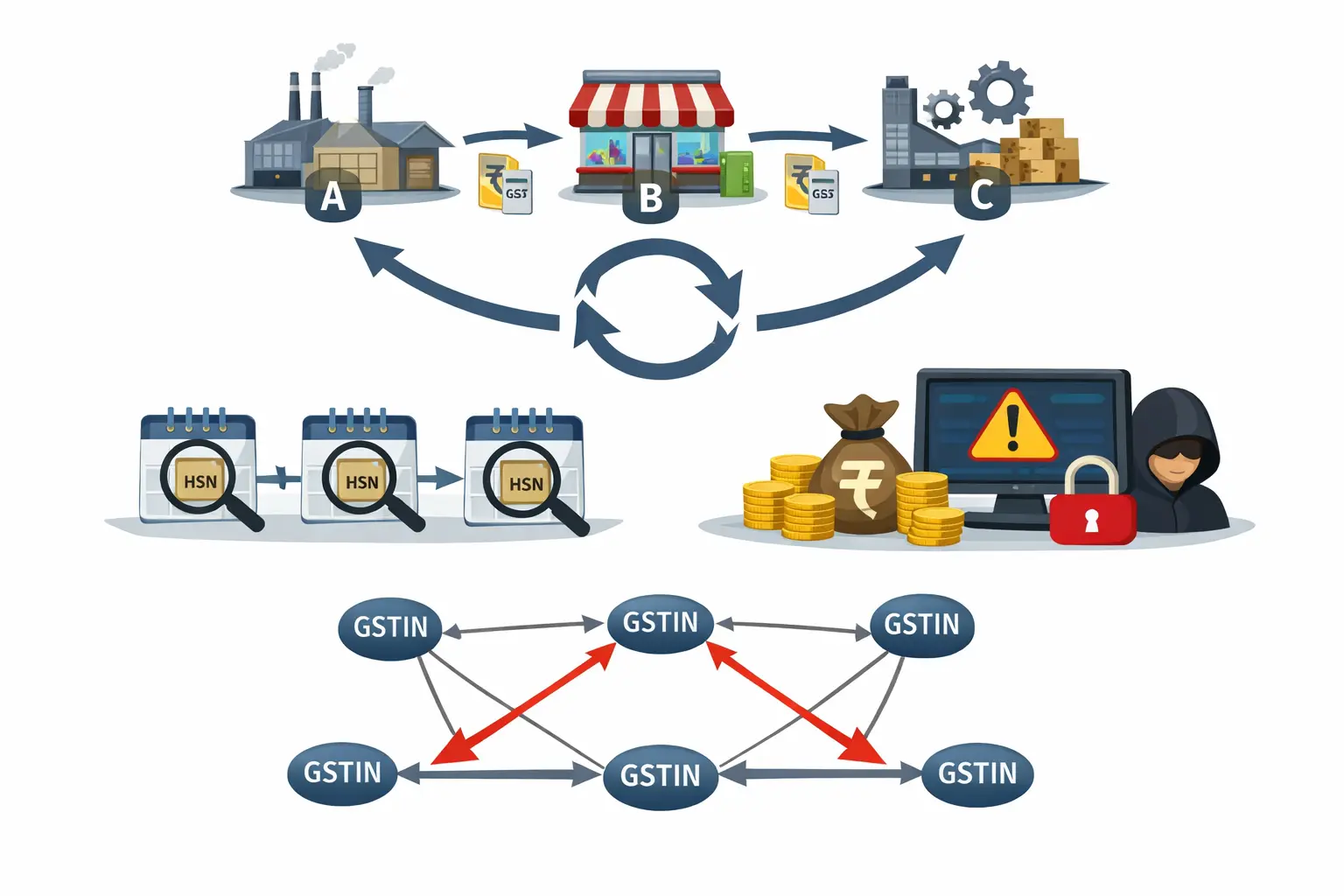

This case study examines how circular transactions involving repeated HSN-level movement across multiple GSTINs enable illegitimate ITC circulation, despite correct filings in GSTR-1, GSTR-3B, and e-way bill data.

At a Glance

- Repeated ITC movement involving the same HSN codes

- Closed-loop trade patterns across multiple GSTINs

- Procedurally compliant returns masking circular intent

Challenges

- Transaction reviews limited to linear buyer–seller analysis

- ITC reconciliation appearing correct at individual GSTIN level

- Lack of end-to-end tracing across multiple transaction hops

- Fragmented visibility across GSTR returns and e-way bill data

Solution

- Tracing ITC movement across multiple GSTINs

- Identifying closed-loop transaction paths (A → B → C → A)

- Detecting repeated HSN continuity across reporting periods

Key Results

Circularity Detection

Identified closed-loop trade patterns involving repeated circulation of the same HSN-mapped goods across multiple GSTINs.

Hidden ITC Exposure

Revealed ITC paths returning to originating entities despite procedurally compliant filings.

Network Visibility

Exposed coordinated GSTIN clusters functioning as circular trade networks rather than independent buyers and sellers.

Intent Clarity

Shifted analysis from individual transactions to end-to-end ITC paths, making concealed intent observable.