Uncovering Coordinated Financial Fraud Across Multiple Compliant Entities

At scale, financial fraud is rarely confined to a single entity.

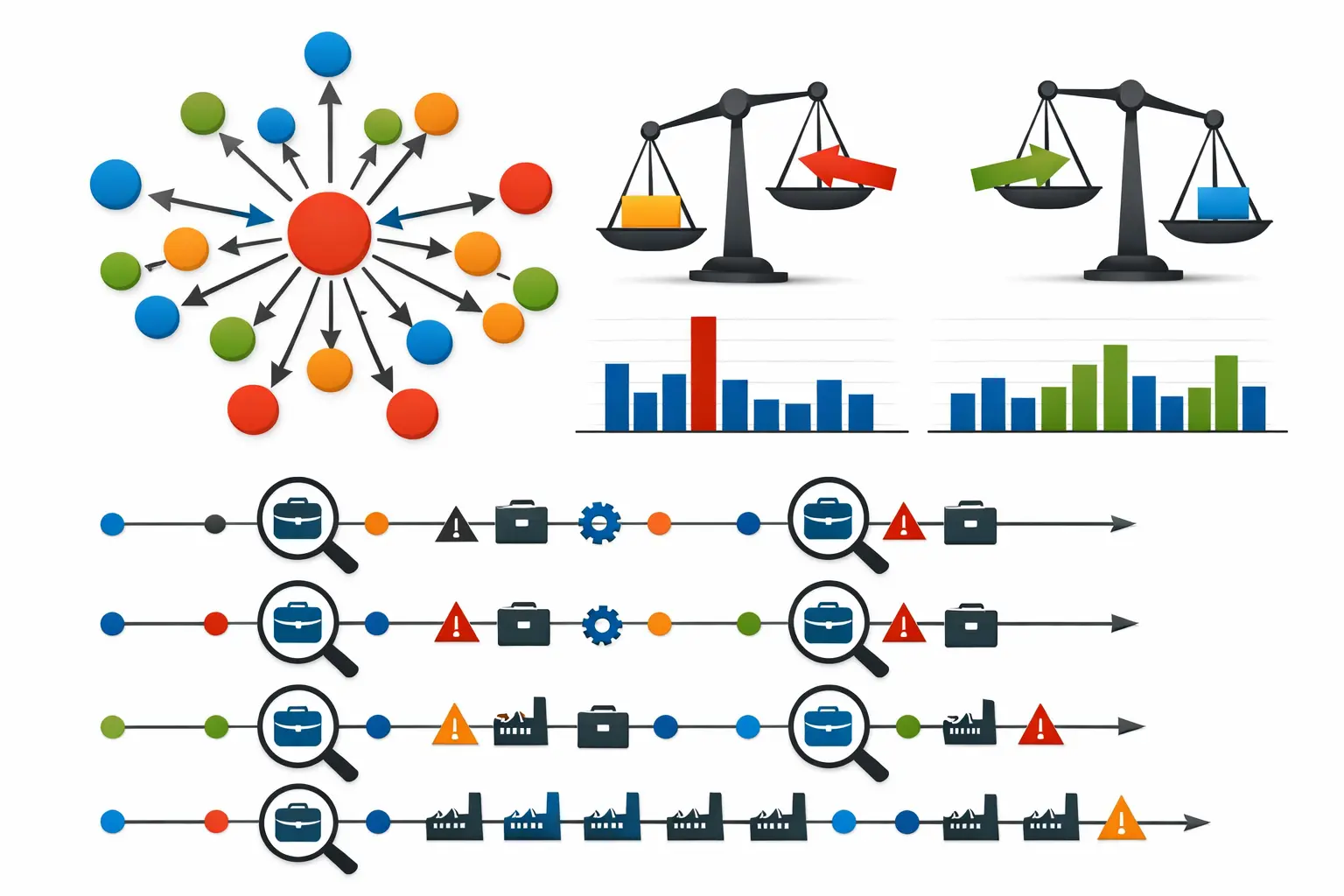

It operates as a coordinated network, distributed across firms, jurisdictions, and reporting periods.

This case study explores how individually compliant entities can collectively enable large-scale financial fraud, and why entity-centric analysis fails to detect intent hidden in networks.

At a Glance

Gradual accumulation of tax credit occurred over multiple reporting periods without corresponding utilisation. Despite this, reporting remained procedurally compliant at every stage.

The underlying risk emerged only when behaviour was analysed over time, revealing patterns that were invisible in period-by-period review.

Challenges

- Oversight models focused on single-entity compliance

- Acceptable ratios and thresholds masking aggregate risk

- Fragmented visibility across jurisdictions and datasets

- Difficulty distinguishing coordination from coincidence

Solution

- Mapping of relationships between entities

- Analysis of inward, outward imbalances at the network level

- Detection of repeated behavioural typologies across firms and time

Key Results

Early Entity Risk

Uncovered coordinated groups of entities operating as a single financial system despite individual compliance.

Behavioural Anomalies

Identified repeated fraud typologies replicated across multiple entities and reporting periods.

Network Exposure

Revealed aggregate financial exposure that remained invisible in entity-by-entity analysis.

Preventive Intelligence

Shifted investigations from isolated entity review to understanding intent at the network level.